Ever heard someone say Margaret doesn’t get its fair share of tax dollars because of our Odenville mailing address? I heard it too — and once elected, I went to work finding the facts.

![]() Here’s what I learned:

Here’s what I learned:

![]() Ad valorem taxes (Property Taxes, like your car tag fees) are distributed based on a 3 part code (seen in the attached photo) assigned to each address, not your zip code. I confirmed this directly with Judge Andrew Weathington and the tax office. Your taxes go to the city based on where you live — not where the post office says you are.

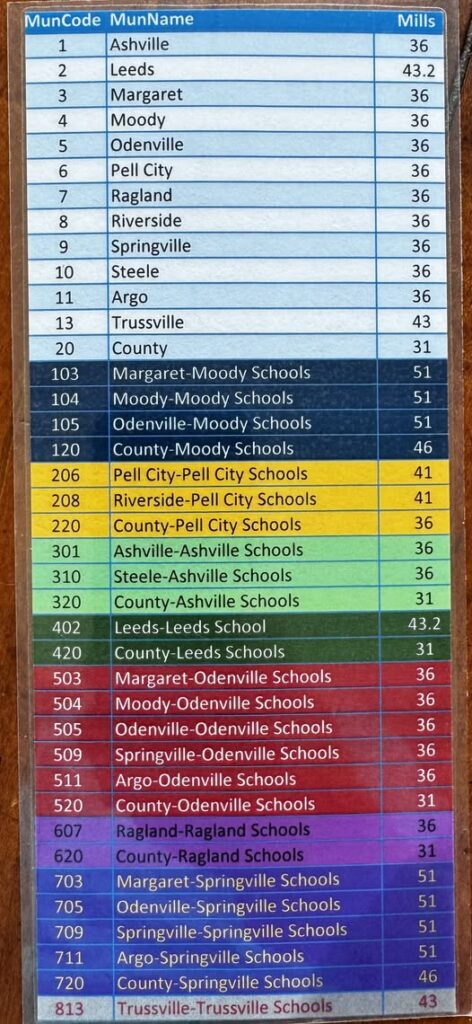

Ad valorem taxes (Property Taxes, like your car tag fees) are distributed based on a 3 part code (seen in the attached photo) assigned to each address, not your zip code. I confirmed this directly with Judge Andrew Weathington and the tax office. Your taxes go to the city based on where you live — not where the post office says you are.

![]() Franchise fees (from utilities like gas or cable) are paid to the city based on service locations — and Margaret receives those directly.

Franchise fees (from utilities like gas or cable) are paid to the city based on service locations — and Margaret receives those directly.

![]() Online sales tax (called SSUT — Simplified Sellers Use Tax) is a separate bucket. The state collects it, then distributes it to counties and cities based on population, not what’s actually bought in Margaret. That means we get a cut — but not always what was purchased by Margaret residents, although our population is the 3rd highest in the county.

Online sales tax (called SSUT — Simplified Sellers Use Tax) is a separate bucket. The state collects it, then distributes it to counties and cities based on population, not what’s actually bought in Margaret. That means we get a cut — but not always what was purchased by Margaret residents, although our population is the 3rd highest in the county.

Bottom line:

![]() We are now getting what we’re owed.

We are now getting what we’re owed.

![]() The zip code myth is mostly outdated — and now fully resolved.

The zip code myth is mostly outdated — and now fully resolved.

![]() I investigated, asked questions, and verified it myself — because facts matter.

I investigated, asked questions, and verified it myself — because facts matter.

This is what real leadership looks like: asking hard questions and sharing the answers with the people.

Leave a Reply